Payday Loans vs Installment Loans: Which is the Right Choice for You?

What is the Difference Between Payday Loans and Installment Loans

The need for cash fast is almost universal. From paying bills to buying groceries, people need cash every day. Fortunately, there are plenty of short-term loan options that can meet almost any need. These loans can be used to tide you over until your next paycheck or save you from bankruptcy. However, not all short-term loan options are created equally.

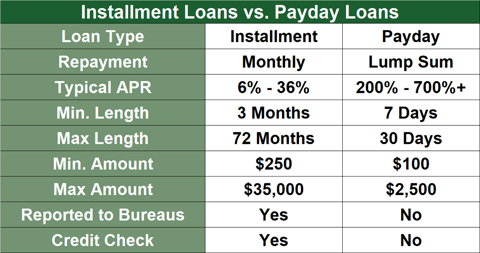

With so many loan options available these days, it can be difficult to know which loan is best for you. The process of obtaining a loan is different based on the lender and whether you are looking to obtain a personal loan or an installment loan. If you’re in need of cash immediately, then an installment loan may be the way to go. These loans are generally short-term in nature and do not require you to make regular repayments over time. On the other hand, if you’re looking for a personal loan that has better terms and conditions than payday loans, then you should definitely look into acquiring an installment loan. These loans have lower interest rates as compared to payday loans and often come with upfront monthly payments that you can repay over time.

With this article, we will go through the pros and cons of both payday and installment loans so that you know which one is right for you.

What is an Installment Loan?

An installment loan is a short-term loan obtained from a financial institution against your full debt. The length of the loan varies based on the financial need of the borrower. Typically, you will make small monthly payments towards your debt until it is fully payoff. Then the loan will be repaid with interest and you will be expected to make monthly payments until the loan is repayable. The terms and conditions of the loan will determine how long you have to repay it and whether you will have to make any payments at all. At the end of each term, you must repay the loan as well as interest. If you fail to do so, the lender can repossess your property, including your vehicle.

What is a Payday Loan?

A payday loan is a short-term loan obtained from a credit union, bank, or other financial institution. Payday loans are often cheaper than traditional forms of financing, but they come with less security. Like an installment loan, you will make small monthly payments towards your debt until it is fully payoff. Then the loan will be repaid with interest and you will be expected to make monthly payments until the loan is repayable. The main difference between a payday loan and an installment loan is that with a payday loan you do not have access to a credit score. This may make it harder for you to get approved for a loan and make payments on it.

How does Installment Loan Works?

An installment loan is a specific type of loan that is obtained from a financial institution against a borrower’s full debt. The loan is secured by the borrower’s property and interest will be charged on the balance if it is not paid within a set time. There are many different types of loans available from financial institutions, including cash advances, loans, and mortgages. A cash advance is a short-term loan obtained from a lender that must be repaid with cash. A loan is generally a long-term debt and has to be repaid with interest. A mortgage is a long-term debt that must be repaid with interest.

How do Payday Loans work?

Like all types of loans, payday loans come with a catch. During a cash advance, lenders take all the information you provide – including your social security number, credit score, income, and amount borrowed – and run a credit report to evaluate your creditworthiness. In many cases, this is done without your knowledge or permission. Once the lender has this information, they can use it to prevent you from getting a loan in the future. This is done by conditioning the loan on the fact that you have to pay it back with interest. You can avoid this by saying no to the loan in question, but that’s easier said than done.

Pros of getting an Installment Loan

You’ll pay less interest on a short-term loan compared to a payday loan. If you pay your bills on time, then you’re unlikely to incur interest. Similarly, you don’t have to make any payments until the loan is repaid. This doesn’t stop you from paying your bills on time, of course, but it makes it less likely for you to be in default on the loan. You don’t have to worry as much about repaying a long-term loan. As an example, you may have heard that people who borrow money against their homes get stuck with higher interest rates. In that case, your best bet may be to find another home loan lender. Your other option may be to find a short-term lender that you can pay off quickly.

Cons of getting a Payday Loan

The length of the loan can be longer than a short-term loan. For example, if you borrow $500, then the term is 36 months, but your payoff is three months from the date you make the loan. The longer the loan, the more interest you will pay. If you can’t repay the loan in full, then the lender can repossess your property, including your car. Make sure you understand the terms and conditions of the loan and whether you have any other options before making a decision.

Is Getting a Payday Loan Right for You?

This is a difficult question to answer because each person’s situation is different. There is no one-size-fits-all answer to it. What we can do, though, is take a look at what types of loans are available to see if any of them might be right for you.

Get the lowest interest rate on a Payday Loan

Payday loans have higher interest rates than other forms of short-term credit. It is important to shop around and find a lender with the best rate. A lender with the best rate may charge more in total, but you will end up paying less in terms of interest because they were charging you a lower rate in the first place.

Get your cash immediately with a Payday Loan

If you need cash immediately, a payday loan may be the right option for you. These types of loans are cash advance loans, so you don’t have to put up any collateral. The lender will take care of the paperwork and issue you a cash loan. These are short-term loans, so you’ll pay them back with cash once the term has elapsed.

Conclusion

Just because one type of loan is good for one situation doesn’t mean it’s the right choice for you in every instance. Each situation is unique and requires its own analysis. In particular, you’ll want to consider your circumstances – is this a short-term or long-term solution for your money worries? – as well as the type of loan and the interest rate.